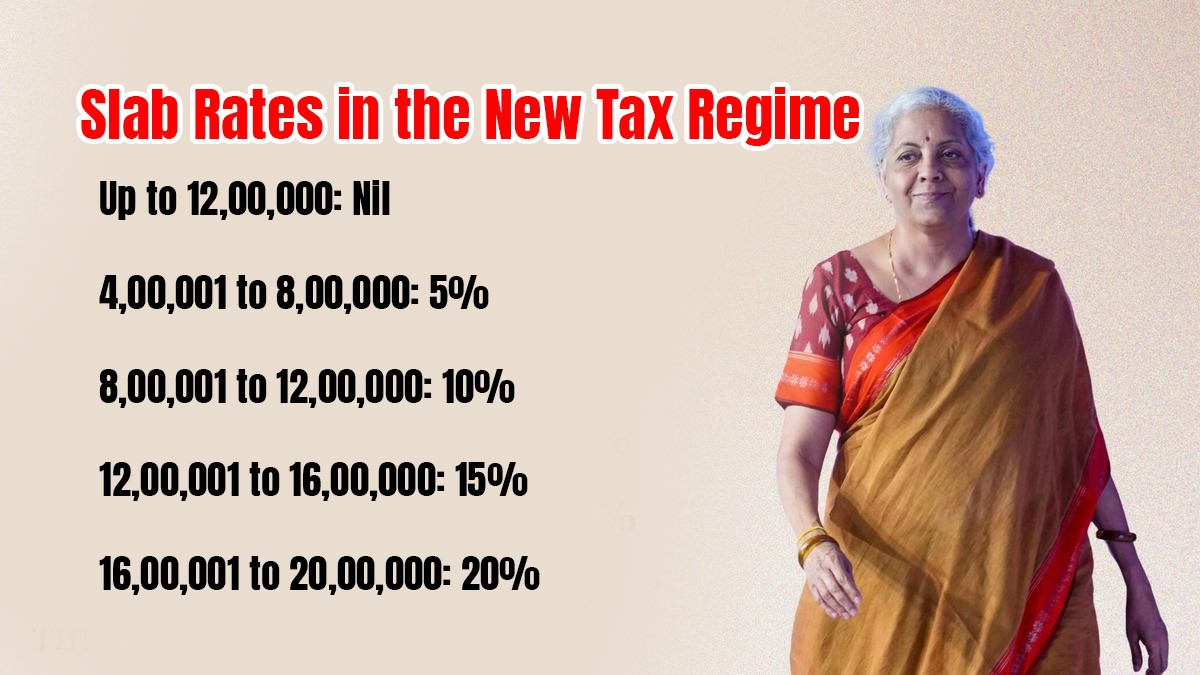

In the Union Budget 2025, Finance Minister Nirmala Sitharaman announced a revised income tax regime with new tax rates aimed at providing relief to taxpayers and simplifying the tax structure. The new tax regime introduces a progressive tax system with the following rates:

Up to 12,00,000: Nil

4,00,001 to 8,00,000: 5%

8,00,001 to 12,00,000: 10%

12,00,001 to 16,00,000: 15%

16,00,001 to 20,00,000: 20%

20,00,001 to 24,00,000: 25%

Above 24,00,000: 30%

This new tax regime is designed to reduce the tax burden on individuals, particularly those in the middle-income bracket, and encourage higher disposable income. By exempting income up to 12 lakh rupees from tax, the government aims to provide substantial relief to a large segment of taxpayers. The progressive tax rates ensure that higher income earners contribute a fair share, while lower and middle-income earners benefit from reduced tax liabilities.

The revised tax structure is part of the government's broader strategy to create a more taxpayer-friendly environment, promote compliance, and stimulate economic growth. The new rates are expected to simplify the tax filing process and make it easier for individuals to understand their tax obligations.